10 Best Life Insurance Companies: Expert-Rated In 2023

If you’re evaluating your financial picture this summer, make sure to consider life insurance. Buying life insurance is an excellent way to gain peace of mind by knowing your loved ones will be financially taken care of when you’re gone.

There are many choices for life insurance that can be a good fit for your financial goals and budget. We evaluated key metrics for term and permanent life insurance from many companies to identify the best life insurance companies.

BEST COST FOR $1 MILLION TERM LIFE

Pacific Life

5.0

Plan name

PL Promise Term

Minimum face amount

$50,000

Level term lengths available

10, 15, 20, 25 or 30 years

Compare quotes from participating carriers via Policygenius.com

Why We Picked It

Pros & Cons

Life Insurance Riders Available

GREAT FOR HIGH ISSUE AGE

Principal

5.0

Plan name

Term life

Minimum face amount

$200,000

Level term lengths available

10, 15, 20 or 30 years

Compare quotes from participating carriers via Policygenius.com

Why We Picked It

Pros & Cons

Life Insurance Riders Available

GREAT FOR LONG LEVEL TERM LENGTH

Protective

5.0

Plan name

Classic Choice Term

Minimum face amount

$100,000

Level term lengths available

10, 15, 20, 25, 30, 35 or 40 years

Compare quotes from participating carriers via Policygenius.com

Why We Picked It

Pros & Cons

Life Insurance Riders Available

LIFE INSURANCE RIDERS AVAILABLE

Symetra

5.0

Plan name

SwiftTerm

Minimum face amount

$100,000

Level term lengths available

10, 15, 20 or 30 years

Compare quotes from participating carriers via Policygenius.com

Why We Picked It

Pros & Cons

Life Insurance Riders Available

BEST FOR BUYERS IN THEIR 50S

Transamerica

5.0

Plan name

Trendsetter Super

Minimum face amount

$25,000

Level term lengths available

10, 15, 20, 25 or 30 years

Compare quotes from participating carriers via Policygenius.com

Term life insurance is a policy where you choose the time period for locking in your rates. Common choices for term length are 5, 10, 15, 25 and 30 years.

When the level term period ends, you can generally renew the policy every year (up to a certain age), although you’ll usually pay much higher life insurance rates at each renewal. That’s why it’s good to properly estimate the best term length when you buy a policy.

You will also choose your coverage amount, which can be into the many millions of dollars if needed.

When you buy a policy you’ll name at least one beneficiary. If you pass away while the policy is in force, your beneficiary receives a death benefit.

If your policy expires and you’re still living, there’s no refund (except when your policy specifically provides a feature called “return of premium”).

Pros and Cons of Term Life Insurance

Here are some potential benefits or drawbacks of term life insurance.

Pros:

- Term life is much less expensive than other forms of life insurance, such as whole life insurance.

- You can choose a level term period that best matches the amount of time for which you need life insurance.

- Your premiums will stay the same for the duration of the level term, so there are no surprises to your budget. Your rates can’t change even if your health changes.

Cons:

- There is no cash value in term life insurance so you can’t take money out of the policy through a loan or withdrawal like you can with cash value life insurance. This lack of cash value is one of the reasons term life insurance is much cheaper than other forms of life insurance.

- If renewal is an option with your policy, the high cost of renewing term life insurance after the level term period ends will come with a serious price tag.

- If you decide to buy a new life insurance policy when your level term period ends, you’ll also pay more. This is because you will be older and may have new health conditions.

What Term Life Insurance Covers

Term life insurance covers deaths of all causes, except for suicide within the first two years of the policy. Deaths caused by illness, disease, accidents and simply old age are all covered by life insurance.

What Term Life Insurance Doesn’t Cover

Here are some situations where a term life insurance provider might not pay out a death benefit.

- Suicide that occurs within the first two years of the life insurance policy

- Death due to a cause that was misrepresented on the life insurance application

When To Choose Term Life Insurance

Term life insurance is suited for people who need life insurance to cover a specific large debt or a finite period of time. Term life can be especially appealing to parents with young families who need financial protection while raising children.

People often buy term life insurance for these reasons:

- Replace lost income. To cover their working years so their family has “income replacement” if they unexpectedly pass away.

- Pay off a mortgage. To cover the years of a large debt such as a mortgage, so that their family can pay it off.

- Pay for college. To cover the years until children graduate from college, to ensure there is tuition money.

- Cover final expenses. To pay for the cost of a funeral.

How Concerned or Unconcerned Are You About Your Family’s Overall Financial Security Today?

The decision to purchase life insurance often boils down to overall financial security. Many people (79%) are concerned about their family’s financial security today, according to a Forbes Advisor survey of 1,000 adults with at least one child under age 18.

| Level of concern about overall financial security | % of respondents |

|---|---|

| Very concerned | 37% |

| Somewhat concerned | 42% |

| Neither concerned nor unconcerned | 14% |

| Somewhat unconcerned | 6% |

| Very unconcerned | 2% |

Having life insurance can help you feel more confident that your life insurance beneficiaries will be taken care of if something happens to you. A survey by the American Council of Life Insurers (ACLI) revealed that more than half (59%) of middle-income earners who have life insurance feel financially secure, compared to 43% of uninsured middle-income individuals.

When it comes to choosing which type of life insurance to buy, many choose term life because it is the most affordable option. Nearly half (48%) of U.S. households with life insurance currently have at least one term life insurance policy, according to ACLI.

| Percent of U.S. households with term life insurance | Median face value |

|---|---|

| 48% | $110,000 |

| Source: ACLI Life Insurers Fact Book 2022 | |

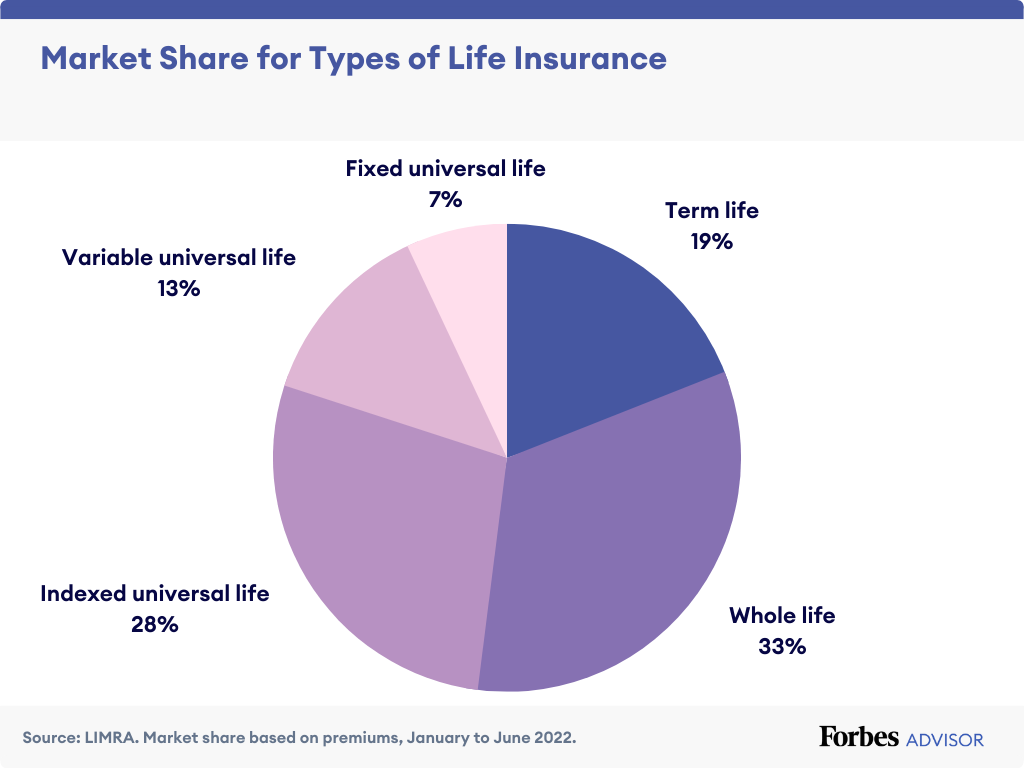

While a large number of households have term life insurance, most of the premiums paid for life insurance go toward permanent life insurance policies such as whole life and indexed universal life insurance, as shown below.

How Much Does a Term Life Insurance Policy Cost?

The average yearly cost for a $500,000 term life insurance policy for a woman age 40 is $264 for a 10-year term, $336 for a 20-year term and $528 for a 30-year term. A man the same age would pay $276 annually for a 10-year term, $408 for a 20-year term and $684 for a 30-year term.

You’ll see in the tables below how rates compare for a $500,000 term life policy and a $1 million term life policy when age and term lengths vary.

Average Annual Costs for $500,000 Term Life Insurance for Women

The average 20-year, $500,000 term life insurance policy for a 40-year-old woman is $336 annually or $28 a month. That’s $72 more annually than a 10-year term policy for a female age 40, but $192 more than a 30-year term policy.

| Age 30 | Age 40 | Age 50 | Age 60 | |

|---|---|---|---|---|

| 10-year term life | $180 | $264 | $432 | $948 |

| 20-year term life | $252 | $336 | $696 | $1,788 |

| 30-year term life | $336 | $528 | $1,200 | N/A |

Average Annual Costs for $500,000 Term Life Insurance for Men

The average 20-year, $500,000 term life insurance policy for a 40-year-old man is $408 annually or $34 a month. That’s $132 more annually than a 10-year term life policy for a male age 40, but $276 less yearly than a 30-year term policy.

| Age 30 | Age 40 | Age 50 | Age 60 | |

|---|---|---|---|---|

| 10-year term life | $216 | $276 | $564 | $1,392 |

| 20-year term life | $300 | $408 | $936 | $2,520 |

| 30-year term life | $444 | $684 | $1,680 | N/A |

Average Annual Costs for $1 Million Term Life Insurance for Women

The average 20-year, $1 million term life insurance policy for a 40-year-old woman is $576 annually or $48 a month. That’s $240 more yearly than a 10-year term life policy for a female the same age, but $408 less than a 30-year term policy.

| Age 30 | Age 40 | Age 50 | Age 60 | |

|---|---|---|---|---|

| 10-year term life | $264 | $336 | $756 | $1,800 |

| 20-year term life | $348 | $576 | $1,260 | $3,528 |

| 30-year term life | $588 | $984 | $2,280 | N/A |

Average Annual Costs for $1 Million Term Life Insurance for Men

The average 20-year, $1 million term life insurance policy for a 40-year-old man is $720 annually or $60 a month.That’s $300 more yearly than a 10-year term life policy for a male the same age, but $564 less than a 30-year term policy.

| Age 30 | Age 40 | Age 50 | Age 60 | |

|---|---|---|---|---|

| 10-year term life | $312 | $420 | $972 | $2,676 |

| 20-year term life | $480 | $720 | $1,740 | $5,064 |

| 30-year term life | $780 | $1,284 | $3,216 | N/A |

Top Reason for Not Buying Life Insurance: Perception of Cost

If you’re already on a tight budget, purchasing life insurance may not be high on your priority list. More than half (53%) of adults who don’t have life insurance think it’s too expensive, according to a Forbes Advisor survey of 1,000 adults in the U.S. with at least one child under 18. Females make up 56% of respondents who think life insurance is too pricey.

But you may find that term life insurance is much more affordable than you think if you get life insurance quotes.

Which of the following best describes why you don’t have a life insurance policy?

In addition to being too expensive, there are other reasons people are choosing not to purchase life insurance.

| Reason for not having life insurance | % of respondents |

|---|---|

| It’s too expensive | 53% |

| I’m too young to think about it | 9% |

| I don’t think it’s worth the cost | 8% |

| I don’t think I need life insurance | 5% |

| Other | 24% |

Factors Affecting Term Life Insurance Rates

The coverage amount and length of term you choose will affect how much you pay for term life insurance. Life insurance companies also typically look at factors that contribute to how long you’re expected to live. This evaluation of “mortality” is the basis for a buyer’s life insurance quote.

Term life insurance cost factors include:

- Age and gender

- Credit and past bankruptcies

- Criminal record

- Driving record (such as DUIs and reckless driving convictions)

- Health

- Health history of your parents and siblings

- Height and weight

- Nicotine or marijuana use

- Past and present prescriptions

- Plans for foreign travel to certain countries

- Results of medical exam (if required)

- Risky hobbies such as scuba diving or skydiving

- Risky occupation

- Substance or alcohol abuse history or treatment

How to Determine How Much Life Insurance You Need

According to the ACLI, there are about 60 million uninsured and underinsured American households, with an average coverage gap of $200,000. To make sure you buy life insurance with enough coverage, use an online life insurance calculator.

Our life insurance calculator asks:

- How much annual income would your dependents need if you were to pass away?

- How long would your dependents need financial support?

- How much debt do you need to pay off?

- How much tuition would you like to cover?

- How much would you like to provide for burial expenses?

- How much savings do you have?

- How much life insurance coverage do you already have?

With these dollar amounts, the calculator instantly computes how much life insurance you need to adequately cover your household debts and future expenses.

How concerned or unconcerned are you about not having enough life insurance coverage?

Falling short on life insurance coverage is a worry for many. More than half (59%) of adults with life insurance say they are concerned about not having enough, according to a Forbes Advisor survey.

| Level of concern among people with life insurance | % of respondents |

|---|---|

| Very concerned | 27% |

| Somewhat concerned | 32% |

| Neither concerned nor unconcerned | 15% |

| Somewhat unconcerned | 14% |

| Very unconcerned | 12% |

One of the best ways to determine how much life insurance you need is to add up the financial obligations you want to cover—for instance, income replacement, a mortgage and credit card debt—and then deduct assets that could be used by your family, such as savings and existing life insurance. You can do this easily by using our life insurance calculator.

How to Choose the Ideal Term Length for Term Life Insurance

After you’ve determined how much life insurance you need, it’s time to decide on a term length.

The main factor in choosing a term length is that it should be long enough to cover your financial obligations. If you need coverage to pay off your mortgage and you’ve got 20 years left, you’ll want no less than a 20-year term policy. If you’ve got 25 years left on your mortgage, but also want to make sure your new baby is covered through college, you may want to consider a longer term of 30 years.

Perhaps you want coverage until you retire, so a payout could be used by your family as income replacement. Then the first step is to estimate when you plan to retire, and keep in mind that the age of retirement in the U.S. has increased. The average age of retirement among retirees is 61, up from 57 in 1991, according to a recent Gallup poll. The average target retirement age of American workers has increased from 60 to 66 over the past 28 years.

Choosing the right term length for your needs is important for multiple reasons. Rates for a longer term are more expensive than for a shorter term, but locking in your rates now for a longer term may end up saving you big in the long run.

If you outlive your term life insurance policy and decide you need to continue coverage, renewing the term policy will result in much higher rates. And even if you decide to shop for a new policy, your age and health at that time will no doubt result in higher life insurance quotes than what you’ll be offered now.

How to Find the Best Term Life Insurance

Close to half (44%) of the respondents in our survey say they are likely to buy new or additional non-work-related life insurance in the next three months.

How likely or unlikely are you to buy a new or additional life insurance policy in the next three months?

Although 44% of survey respondents say they are likely to get a new or additional life insurance policy in the next three months, 34% say they are unlikely to.

| Likelihood of buying new or additional insurance in the next three months | % of respondents |

|---|---|

| Very likely | 21% |

| Somewhat likely | 23% |

| Neither likely nor unlikely | 22% |

| Somewhat unlikely | 15% |

| Very unlikely | 19% |

When you’re shopping for term life insurance, it may be tempting to look only at the prices offered. While price is an important factor, it is not the only one.

Here are some tips for how to find the best term life insurance coverage.

Compare Quotes From Multiple Life Insurance Companies

Your age and health play a substantial role in your term life insurance quotes and the coverage available to you. It’s important to compare life insurance quotes from multiple companies so you’ll be able to identify the true best value.

If you have health issues, work with an experienced life insurance agent who can identify insurers most likely to give you the best rates. Smokers, marijuana users and others with “risks” (such as heart condition or DUI conviction) can also benefit from working with an experienced life insurance agent.

Consider Coverage Features in Addition to Cost

Yes, cost is very important when selecting a life insurance policy. But don’t focus solely on price or you may sell yourself short on finding the best term life insurance policy and insurer for your needs. Here are some term life coverage features to look for:

- A term life conversion feature allowing you to convert the term policy into a permanent policy in the future. You’ll be glad you have this feature in the future if you develop health problems and decide you want to extend your life insurance coverage.

- Living benefits that offer the option of accessing your death benefit for various reasons while you’re still living. For example, an accelerated death benefit will let you take money from your own death benefit if you develop a terminal illness in the future.

- Life insurance riders that give you the flexibility of customizing a term life policy. For example, a waiver of premium rider will waive your life insurance payments if you become disabled in the future.

Ask About the Policy’s Accelerated Death Benefit

The best term life insurance companies offer an accelerated death benefit, which is a type of living benefit. If you become terminally ill, an accelerated death benefit allows you to access your death benefit while you’re still living. Some insurers offer this same feature if you become chronically or critically ill.

If you utilize the accelerated death benefit, your beneficiaries will receive a reduced payout at the time of your death. How much you can access and the qualifying rules vary by the insurance company.

Ask About Term Life Conversion

Converting a term life insurance policy into a permanent life insurance policy is a feature offered by most of the best term life insurance companies. This feature allows you to trade your term life policy for a permanent policy, such as whole life insurance or universal life insurance.

Check the rules for conversion with any insurer you consider. You usually must make a conversion during your level term period or before, and most companies also have an age cap—whichever comes first is your deadline for converting.

Related: Term Vs. Permanent Life Insurance

Find Out the Rules for Renewing the Policy

Term policies provide set rates for the level term period, such as 10, 20 or 30 years. During that time, you pay a fixed premium. Many insurers allow you to renew the policy after the initial level term period ends, up to a certain age. However, the cost of renewing term life insurance can be exorbitant, so be sure to consider that when weighing your options and shopping for term life insurance. It’s better to buy a long policy from the start, rather than count on the option of renewal in the future.

Leave a Comment